Open a comdirect account with just a few clicks

comdirect, one of the most established online banks in Germany, has been offering online identification from AUTHADA since 2018. This has made it even easier for customers to open a comdirect custody account. comdirect was the first direct bank to use AUTHADA ident in the SDK integration version to open a custody account. The AUTHADA solution is thus fully integrated into the comdirect app and has the familiar yellow comdirect style. Every comdirect account account can now be opened by using the eID solution.

The AUTHADA solution in operation

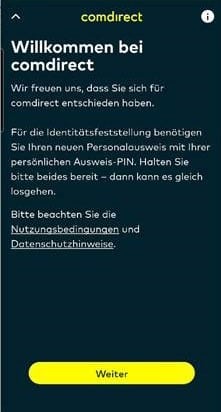

Thanks to AUTHADA, comdirect customers can identify themselves without having to wait and without having to contact anyone. In addition to video legitimation, the bank also offers legitimation verification via the eID function. By integrating the AUTHADA solution as an SDK variant (Software Development Kit), users benefit from a seamless customer experience in comdirect’s application channels and digital identity verification. It is therefore possible to open a comdirect account without having to leave the online bank’s application. Online identification via the eID function ensures maximum flexibility, the highest level of reliability and data security. The online identity check is completed in less than a minute. The number of customer transactions continued to grow thanks to the addition of online identification via eID. At the same time, the costs for online identification fell. An enrichment for customers and for comdirect!

This is where comdirect users start their identification © Image: comdirect

Thore Ludwig, Head of Business Management at comdirect:

>>We are delighted that we can now also use the E-Ident procedure when opening all comdirect custody accounts and accounts. Completely digital identity verification makes our customers’ lives easier – that is precisely our goal as a smart financial partner.<<

SDK-Integration of ident

“SDK” variant: Customer app & customer website

For the integration of the AUTHADA solution ident, comdirect has opted for our SDK integration variant. Customers start the identification process on the comdirect website or in the comdirect app. The AUTHADA solution is fully implemented in the app so that customers can identify themselves without leaving the yellow comdirect corporate design.

![integration_free_sdk[1] Integration Variante SDK](https://authada.de/wp-content/uploads/2023/02/integration_free_sdk1.png)

More integration possibilities

Individuell und passend für Ihre Bedürfnisse

AUTHADA offers additional integration variants for the integration of the identification solution ident. With the “Easy” variant, customers are redirected from their provider’s website to the AUTHADA identification website. Here they start the process and can complete the identification using the AUTHADA app. With the “Customized” variant, customers start the identification process on their provider’s website and complete it with the AUTHADA app.

![integration_free_easy[1] Integration Variante Easy](https://authada.de/wp-content/uploads/2023/02/integration_free_easy1.png)

Integrationsvariante “Easy”

![integration_free_customized[1] Integration Variante Customized](https://authada.de/wp-content/uploads/2023/02/integration_free_customized1.png)

Integrationsvariante “Customized”

Further customer Projects: AUTHADA solutions in use

Make provisions for emergencies and provide clarity for relatives: This is possible digitally and legally compliant with Afilio. The pension platform offers individuals, couples and families the opportunity to record their wishes in the event of an emergency. Since 2024, the company has relied on AUTHADA's digital signature to ensure that precautionary documents are always available at any time and any place.

comdirect, one of the most established online banks in Germany, has been offering online identification from AUTHADA since 2018. This has made it even easier for customers to open a comdirect account. comdirect was the first direct bank to use AUTHADA ident in the SDK integration version to open a custody account.

To open a bank account or a deposit account, banks are required to carry out an identity check to establish a person's identity. Anyone who wants to open an account online must also undergo an online identity check. At BW-Bank, this has been possible since 2020 not only via video identity between 8 a.m. and 10 p.m., but 24/7 thanks to AUTHADA ident and the eID function of the ID card.