Fraud prevention in e-commerce | fashionette

The online shop for premium and luxury fashion accessories fashionette has been using innovative technology to prevent the misuse of stolen identities in its online shop since 2022. With the help of AUTHADA’s solution ident, customers are protected from identity fraud and identity theft through a secure identification process. This is how fraud prevention works today.

The challenge

Fraud prevention and ensuring DSGVO compliance

The premium and luxury fashion accessories offered by fashionette are high-quality and exclusive – the risk of fraud attempts is correspondingly high. The study “Fraud in e-commerce” by the credit agency CRIF Bürgel shows a continuous increase in fraud in online retail. In 2021, 91 percent of online retailers in the DACH region have experienced fraud or attempted fraud during the last 12 months – a new record. To prevent fraud, the identity of the ordering party must be verified. However, manual verification, e.g. of ID pictures, is time-consuming, not forgery-proof and poses a challenge for compliance with the german GDPR. Another solution to combat online fraud had to be found.

The AUTHADA solution in operation

Fraud prevention thanks to ident

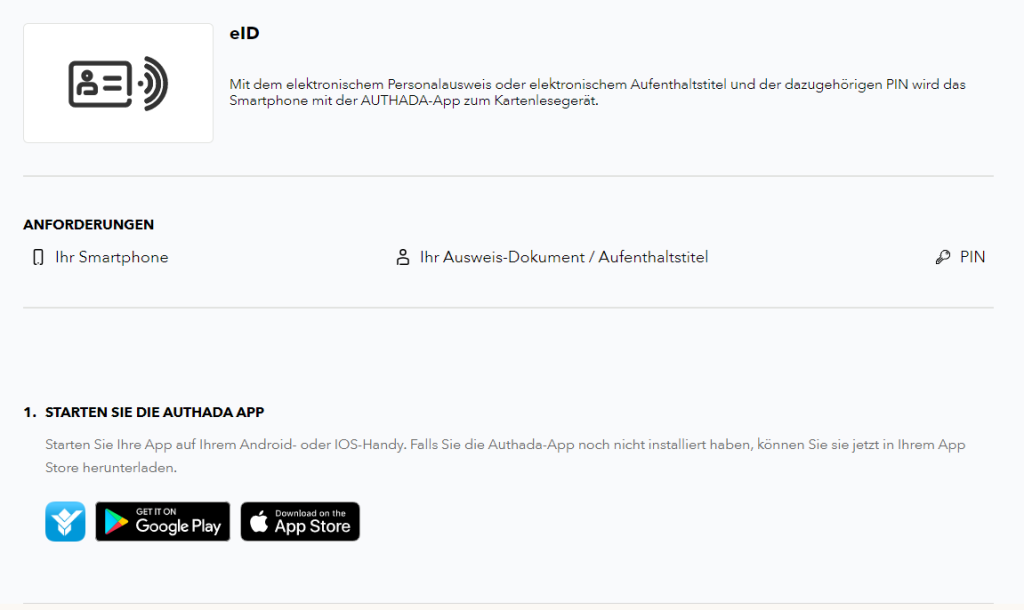

With AUTHADA ident, fashionette customers are securely identified without media disruption and in just a few steps. All they need for online identification is their identity card (alternatively their European residence permit or the eID card for EU citizens), the corresponding PIN and a smartphone. Since identification takes place in a few seconds, a unique shopping experience is maintained.

In terms of fraud prevention, AUTHADA checks the authenticity of the ID document, transmits the data in encrypted form and also ensures both DSGVO compliance and a deletion concept with regard to personal data. This not only means security for fashionette and its customers, but also for all other persons. “Our goal is for all persons to be able to move safely on the internet through our solutions,” says CEO and co-founder of AUTHADA, Andreas Plies. Thanks to the introduction of AUTHADA ident, anyone who has been the victim of identity theft will not find a bill from fashionette in their letterbox.

This is where fashionette users start their identification // © Image: fashionette

Laura Vogelsang, Head of Risk & Payment at fashionette:

>>When I first heard about AUTHADA ident, I was very interested. fashionette is continuously working on making the shopping experience for its customers even more attractive and secure. In my opinion, AUTHADA ident offers many advantages over other solutions currently on the market.<<

Kristina Schorch from fashionette:

>>With ident we have an identification solution without waiting time. At any time and from anywhere, our customers can identify themselves without having to communicate with another person or go to a post office.<<

Customized-Integration from ident

“Customized” variant: Our app & customer website

For the integration of the AUTHADA solution ident, fashionette decided on our “Customised” integration option. Customers start the identification process on the fashionette website. Here they receive a QR code or ident code which they scan or enter with the AUTHADA app on their smartphone. The identification process is completed in less than a minute! Little effort and individual website design.

![integration_free_customized[1] Integration Variante Customized](https://authada.de/wp-content/uploads/2023/02/integration_free_customized1.png)

More integration possibilities

Individual and suitable for your needs

For the integration of the identification solution ident, AUTHADA offers other integration variants. With the “Easy” variant, customers are redirected from their provider’s website to the AUTHADA identification website and can carry out the identification with the help of this and the AUTHADA app. In the “SDK” variant, our solution is fully integrated into the company’s website and app. AUTHADA’s technical solution works in the background.

![integration_free_easy[1] Integration Variante Easy](https://authada.de/wp-content/uploads/2023/02/integration_free_easy1.png)

“Easy” integration variant

![integration_free_sdk[1] Integration Variante SDK](https://authada.de/wp-content/uploads/2023/02/integration_free_sdk1.png)

“SDK” integration variant

Further customer Projects: AUTHADA solutions in use

Make provisions for emergencies and provide clarity for relatives: This is possible digitally and legally compliant with Afilio. The pension platform offers individuals, couples and families the opportunity to record their wishes in the event of an emergency. Since 2024, the company has relied on AUTHADA's digital signature to ensure that precautionary documents are always available at any time and any place.

comdirect, one of the most established online banks in Germany, has been offering online identification from AUTHADA since 2018. This has made it even easier for customers to open a comdirect account. comdirect was the first direct bank to use AUTHADA ident in the SDK integration version to open a custody account.

To open a bank account or a deposit account, banks are required to carry out an identity check to establish a person's identity. Anyone who wants to open an account online must also undergo an online identity check. At BW-Bank, this has been possible since 2020 not only via video identity between 8 a.m. and 10 p.m., but 24/7 thanks to AUTHADA ident and the eID function of the ID card.