Use Case: Open a bank account at the POS

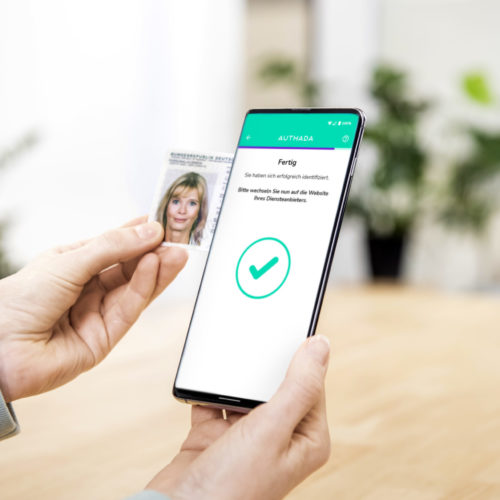

Onsite but digital: Read out KYC documents

Customer onboarding in the bank branch is one of the most frequent processes. For the advisor, this means having to make a decision when manually entering the ID document data for the kyc process: Either have the customer wait to avoid mistakes due to distraction or talk to the customer and accept possible mistakes. With AUTHADA onsite, this decision and the manual data entry are no longer necessary. With onsite, reading out KYC documents is automatically done with just a few clicks via the eID function or via OCR for kyc process. While the data is transferred to your system in a matter of seconds, your employees have the time to devote themselves fully to their customers.

Advantages of AUTHADA

- Combine digitization, progressiveness and regulation!

- Make your processes more than 50% more efficient.

- Complete the KYC process and signing of a contract in half the usual time.

- Increase data quality and rely on the fully automated transfer of data into your system.

- Data and documents are archived immediately thanks to the integrated scan function.

- If you wish, you can also have photos and OCR data provided.

- Save not only time, but also paper and contribute to sustainability.

And this is how onsite works

Open AUTHADA onsite

Open AUTHADA onsite on your mobile device and follow the instructions in the application.

Capture photos

Use the app to capture your customer’s identity documents.

Read the ID card via NFC/OCR

In the course of this, AUTHADA onsite reads out your customer’s ID data.

Data are transmitted

The photos as well as the data of the ID documents are automatically transferred to your system and archived there.

The solutions for your processes

AUTHADA sign

Do you connect contract signatures with time-consuming processes, filled files and travelling? Not any more! Thanks to sign, handwritten signatures are no longer necessary – even for official documents. You save paper and printing costs and travelling is not necessary anymore. Reduce your ecological footprint easily!

Our customer projects: AUTHADA solutions in use

Customers of this banking institution can open their account without media discontinuity immediately and effortlessly. Impressive in the in the splendour of their own corporate design, the process of online identification can be completed independently using a German identity card, residence permit or eID card for EU citizens.

In addition to video identification, this financial service provider also offers its customers AUTHADA ident as an option for identification using an ID card and the NFC interface of the mobile phone. This is in line with the consumer behaviour of our digital age, in which customers are used to performing their transactions independently.

A well-known travel provider’s system is now becoming digital, fast and sustainable. This not only optimizes processes, but also conserves resources. Thanks to AUTHADA sign, travel financing applications are now processed entirely digitally.