Financial sector

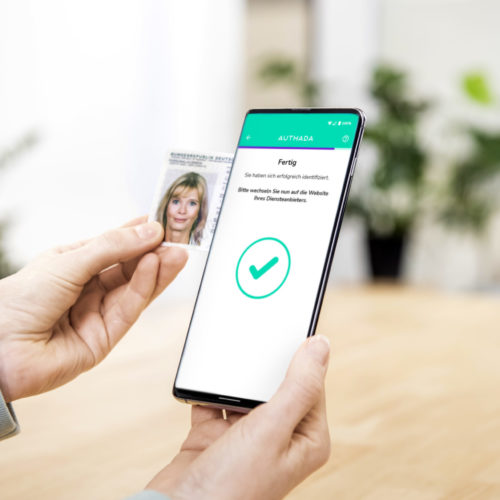

KYC- & AML-compliant: Customer onboarding in less than 4 minutes

From online identification and legally compliant (qualified) digital signatures (QES) to fully automated KYC-compliant customer onboarding at the point of sale – our portfolio has the right solution for you. And of course, all of it compliant with the AML act with a maximum level of efficiency and customer orientation!

Trusted by

Optimize your processes. Create new possibilities.

More growth

- Make your services available 24/7.

- Be reachable from anywhere.

- Address a large audience.

More efficiency

- Provide seamless application processes.

- Cut the KYC process in half.

- Increase your data quality through automated transfer to your system.

More security

- Have the authenticity of ID documents reliably verified.

- Comply with regulatory requirements.

- Ensure data protection.

The solutions for your processes

AUTHADA sign

Do you connect contract signatures with time-consuming processes, filled files and travelling? Not any more! Thanks to sign, handwritten signatures are no longer necessary – even for official documents. You save paper and printing costs and travelling is not necessary anymore. Reduce your ecological footprint easily!

Regulatory requirements

At AUTHADA we guarantee the highest level of security and protection for your customers’ data. AUTHADA’s solutions are compatible with numerous regulations and laws and in some cases exceed the legal requirements for security and data protection.

An GwG-compliant identification can be implemented with the help of electronic proof of identity (Section 18 of the German Identity Card Act) and the electronic residence permit (Section 78 (5) of the German Residence Act), in accordance with Section 12 (1) sentence 1 No. 2 GwG. The obligations to preserve records resulting from this identification procedure (as per Section 8 (2) sentence 5) require the “service and card-specific marking”, which we provide with the data for identification.

According to Section 18 and Section 18a of the PAuswG (Section 78 (5) of the AufenthG for residence permits and Section 12 of the eIDKG for eID cards for Union citizens), reading the electronic proof of identity (eID) is a reliable process for reading ID card data online and on site. Before the data is read out, it is verified whether the person presenting the eID card is the cardholder. Before the data is read out, it is checked whether the person presenting the ID document is also the cardholder. In the case of on-site reading, this is done by a employee on site; in the case of online identification, it is done with the help of the personal ID PIN.

The eIDAS Regulation regulates electronic identification and electronic trust services all over Europe. The German eID has already been successfully notified and will be able to be used for identification in the EU in the future. The implementation of the eIDAS Regulation is outlined in the Trust Service Act (VDG). Moreover, as per eIDAS, a remote signature can be initiated via the German eID.

Our customer projects: AUTHADA solutions in the financial sector

Customers of this banking institution can open their account without media discontinuity immediately and effortlessly. Impressive in the in the splendour of their own corporate design, the process of online identification can be completed independently using a German identity card, residence permit or eID card for EU citizens.

In addition to video identification, this financial service provider also offers its customers AUTHADA ident as an option for identification using an ID card and the NFC interface of the mobile phone. This is in line with the consumer behaviour of our digital age, in which customers are used to performing their transactions independently.

A well-known travel provider’s system is now becoming digital, fast and sustainable. This not only optimizes processes, but also conserves resources. Thanks to AUTHADA sign, travel financing applications are now processed entirely digitally.