Start investing quick with online identification | VisualVest

Low interest rates have ensured in recent years that many people have started to invest their money instead of just saving it. The management of a portfolio, which is also associated with effort, can be kept very low thanks to a digital asset manager, a so-called “Robo Advisor”. One such robo advisor is VisualVest. In order to make not only portfolio management but also the opening of a portfolio as simple as possible, VisualVest 2020 has decided to use AUTHADA’s ident solution. Asset building can be this simple and progressive!

The challenge

Simplify opening a portfolio and make it possible at any time

In order to start investing with a robo advisor, clients must open a portfolio online. A legal requirement is the identification of the person. Until now, this could only be done with the help of video identification. For customers, this means the obligation to show themselves in front of the camera in the video call. In addition, waiting times have to be accepted if there are many simultaneous enquiries. For VisualVest, video identification means extensive forecasts, the number of expected account closings for the following month must be made. The digital asset manager thus incurs high costs – on the one hand due to customers who do not close the account because of the video legitimation, and on the other hand due to forecasts and the provider costs for the video legitimation.

The AUTHADA solution in operation

By integrating AUTHADA ident, VisualVest enables its clients to start investing by using their preferred identification. Using digital identification with AUTHADA ident via eID, clients can confirm their identity and complete the application within a very short time. In doing so, they enjoy full freedom, do not have to show themselves in front of the camera and do not have to put up with waiting times. For online identification, all they have to do is hold their ID card up to the NFC interface of a smartphone and confirm their identity by entering their ID card PIN.

More freedom for VisualVest & its customers

For VisualVest, online identification with AUTHADA ident means the possibility to perform customer onboarding at any time – without the need for video identification. In addition to maximum scalability, the costs of identification via eID and AUTHADA ident are also halved. Cumbersome processes, such as forecasts for the next few months, are no longer necessary.

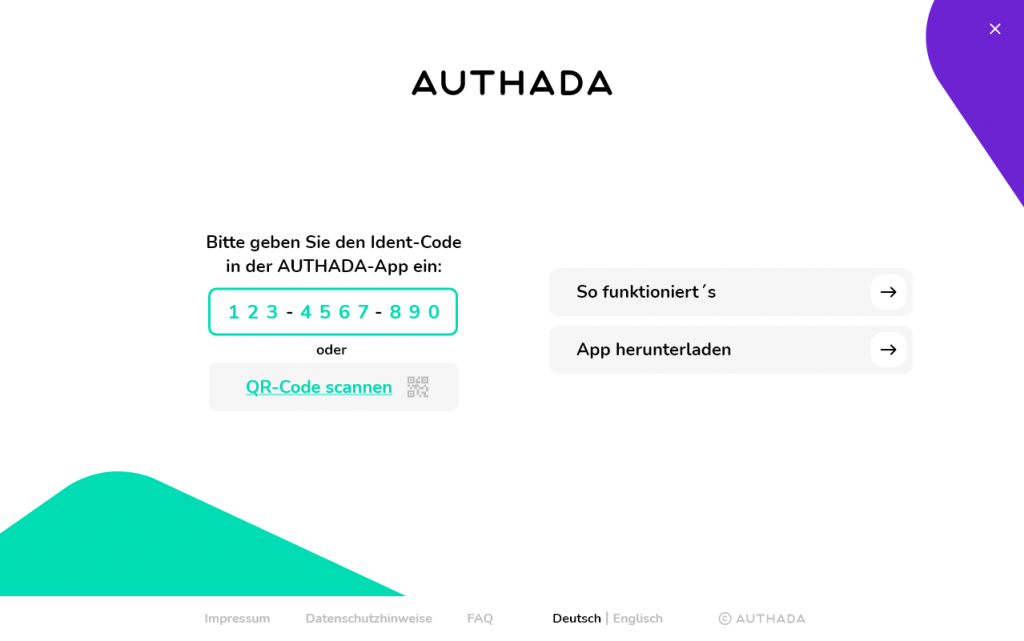

This is where VisualVest users start their identification process

Marco Zohren, Head of IT at VisualVest:

>>With the AUTHADA app, nothing stands in the way of an even faster opening of a portfolio. Identification via eID is a perfect fit for us and our target group, who want to manage their investments digitally and easily. With the AUTHADA app, all data from the electronic ID card is automatically transferred which significantly speeds up the legitimisation process.<<

EASY-Integration of ident

Variante “Easy”: Our App & our Website

For the integration of the AUTHADA solution ident, VisualVest has chosen our “Easy” integration variant. Customers are redirected from the VisualVest website to the AUTHADA identification website. Together with the AUTHADA app, customers identify themselves in less than one minute.

![integration_free_easy[1] Integration Variante Easy](https://authada.de/wp-content/uploads/2023/02/integration_free_easy1.png)

More integration possibilities

Individual and suitable for your needs.

AUTHADA offers further integration variants for the integration of the solution ident. With the “Customised” variant, customers do not leave the corporate design of the company during identification and read the ID card with the AUTHADA app. With the “SDK” variant, our solution is fully integrated into the company’s website and app, and customers enjoy a smooth customer journey. The technical solution from AUTHADA runs in the background.

![integration_free_customized[1] Integration Variante Customized](https://authada.de/wp-content/uploads/2023/02/integration_free_customized1.png)

Integrationsvariante “Customized”

![integration_free_sdk[1] Integration Variante SDK](https://authada.de/wp-content/uploads/2023/02/integration_free_sdk1.png)

Integrationsvariante “SDK”

Further customer Projects: AUTHADA solutions in use

Make provisions for emergencies and provide clarity for relatives: This is possible digitally and legally compliant with Afilio. The pension platform offers individuals, couples and families the opportunity to record their wishes in the event of an emergency. Since 2024, the company has relied on AUTHADA's digital signature to ensure that precautionary documents are always available at any time and any place.

comdirect, one of the most established online banks in Germany, has been offering online identification from AUTHADA since 2018. This has made it even easier for customers to open a comdirect account. comdirect was the first direct bank to use AUTHADA ident in the SDK integration version to open a custody account.

To open a bank account or a deposit account, banks are required to carry out an identity check to establish a person's identity. Anyone who wants to open an account online must also undergo an online identity check. At BW-Bank, this has been possible since 2020 not only via video identity between 8 a.m. and 10 p.m., but 24/7 thanks to AUTHADA ident and the eID function of the ID card.